Mobile App to Track Rental Properties and Upload Receipts

![]()

Tracking rental property expenses is an of import part of investing in real manor. Information technology's also one of the least favorite things that most real estate investors want to practise.

The skilful news is that keeping runway of the expenses of owning and operating rental property is easy when you use the best modern software specifically built for residential income belongings investors.

Why It'due south Important to Stay Organized

In society to gain the most from your rental property investment, it's important to study all of your income and expenses as much equally y'all (legally) tin can. That's why good tape keeping is and then important for real estate investors.

According to a postal service on BiggerPockets , large or vague deductions are 1 of the top three IRS audit areas every real estate investor needs to know.

Staying organized not merely reduces the risk of getting audited. It also makes information technology easier to track your profitability from one calendar month to the side by side, and helps ensure that y'all are taking every tax deduction yous're entitled to at the stop of the twelvemonth:

- If you're e'er audited by the IRS, you'll have to bear witness your rental expenses are legitimate. Expenses that can't be backed up with a receipt or proof of payment will be rejected. The IRS will recalculate your taxes for you, and appraise additional taxes, penalties, and interest.

- Keeping detailed records and backup all in one identify makes information technology much easier to accurately rails the truthful fiscal functioning of your rental belongings and avoids errors when filing a taxation return.

- Accurate record-keeping also reduces the risk of overpaying your taxes by not claiming every deduction yous're entitled to as a real estate investor.

Records That Rental Holding Owners Need

There are two types of records that owners of rental property need to go along:

- A record of incomes and expenses for each rental belongings, unremarkably in the form of a P&L (profit & loss) statement.

- Redundancy or supporting documents – such as receipts, credit card or bank statements – to evidence that the income and expenses on your P&50 are authentic and legitimate.

That might sound easy enough. But the truth is it'southward easy to become overwhelmed by record keeping. Especially when you consider all of the potential expenses involved, even if you're just starting out and own a single rental home.

Here are some examples of records to go along:

- Settlement statements, escrow reports, and inspection documents from when you first purchased the holding.

- Tenant leases for current and past tenants, including applications and tenant screening reports.

- Tenant-related documents such as commissions paid, maintenance requests and repairs made, and late rent notices sent.

- Proof of rental payments received, the amount, and the date the hire payment was received.

- Bank statements from the belongings operating account, to show that personal and business funds are non being commingled.

- Copies of expense receipts such every bit utility bills, material and labor, supplies, and other costs directly related to owning and operating the rental property.

- Invoices from professional service providers such as leasing agents, holding management companies, lawyers, and accountants.

- Expenses related to marketing a vacant property for rent, such as online advertizing fees, tenant screening reports, and lease training costs.

- Mortgage loan documents and a detailed record of loan payments made, including a breakup of principal, interest, taxes, and insurance (PITI).

- Records of sales or rental tax paid to the urban center or state for the monthly rent received from each property and tenant.

- Copies of federal, state, and local revenue enhancement returns going dorsum several years (ask your auditor or CPA what the all-time practices are for your business organization.

What is Included in Rental Property Expenses?

Each holding expense is called a "line item" on your P&L. Specific line particular expenses will differ between property types and real estate investors.

For example, owners of multifamily property with common area parking may have an expense line item for parking lot maintenance. On the other hand, single-family homes often have a driveway or on-street parking, so there isn't a parking lot to maintain.

Depending on the type of property you have – single-family rental , multifamily, or condo – and the part of the country it'due south located in, rental property expenses fall into one of two categories:

Maintenance, Repairs, and Utilities

- Alarm system

- Cable

- Cleaning

- Electricity

- Gas

- HOA dues

- Landscaping

- Maintenance

- Pest control

- Sewer

- Snowfall removal

- Trash

- Water

General Operating Expenses

- Advertising

- Auto and travel expense

- Dues and subscriptions

- Leasing fees

- Licenses

- Mortgage interest

- Part supplies

- Other interest

- Professional services

- Property insurance

- Property management fees

- Holding supplies

- Property taxes

- Rental or sales taxes

- Applied science and software

- Telephone

In addition to the higher up expenses, real manor investors are as well allowed to claim a depreciation deduction, up to 27.5 years for a residential rental.

Depreciation is a not-cash deduction rental property owners apply to reduce taxable net income. For example, if yous paid $140,000 for a single-family rental (excluding the value of the lot), you could take a depreciation deduction of $5,090.91 ($140,000 / 27.5 years) plus all of the other tax-deductible expenses above.

How to Runway Rental Holding Expenses

There are a number of online software programs a real manor investor tin utilize to track rental holding expenses.

Some examples include a basic Excel spreadsheet from Zillow , personal and business concern bookkeeping software programs similar Quicken and TurboTax , and belongings management systems such as Cozy and TenantCloud .

Nonetheless, the well-nigh successful investors employ Stessa to track their real manor investments. That's considering Stessa is an asset management system designed by existent estate investors for real estate investors. The company has been featured in publications such equally BiggerPockets, Forbes, The New York Times, The Wall Street Journal, and Inman.

Stessa's rental belongings asset management software solution for landlords works across an entire portfolio of rental properties, from one single-family unit rental home to dozens of homes, multifamily avails, and brusque-term rentals.

What Stessa Does

Stessa is a cloud-based asset management system that makes tracking real estate investments simple.

Real estate investors tin access their Stessa dashboard from any computing device, including a desktop or laptop, tablet, or smartphone app from both Google Play and the App Store:

- Rail unlimited properties.

- Use performance dashboards at both the belongings and portfolio levels.

- Automatically track income and expenses with a newspaper trail.

- Upload, organize, and store all real estate documents including expense receipts, leases, and inspection reports.

- Run unlimited monthly financial reports including P&L income statements, internet greenbacks flow, and capital expenses.

- Consign tax-fix financials to simplify filing at revenue enhancement time with software from the Stessa Tax Center .

- Access your portfolio from anywhere in the earth with an internet connection.

- Collaborate with business organization partners, fellow investors, family and friends.

- Track and upload expenses on-the-get with iOS and Android apps.

- Get valuable resources to aid scale up and optimize your rental property portfolio.

- Access the latest real estate news and trends that help investors stay on top of their game.

Security is too a top priority at Stessa. The software uses the industry's best security encryption and robust multi-factor authentication to brand certain that your private data remains private. Information is never shared without your permission.

How Stessa Works

You can prepare a property in Stessa and start tracking your real estate investments in 5 like shooting fish in a barrel steps:

- Sign upwards for Stessa with your electronic mail address

- Enter your belongings address

- Connect accounts apace and securely

- Run the reports y'all need with a single click

- Monitor each property and the entire portfolio from your dashboard

In but 5 minutes you're good to go.

Begin using Stessa to track rental performance to maximize your revenue based on your unique portfolio and investment strategy. Automate income and expense tracking with intuitive features that car-categorize transactions for easy reporting and tax training.

By having all of your finances and documents in one place, y'all'll be able to manage and grow your portfolio with confidence.

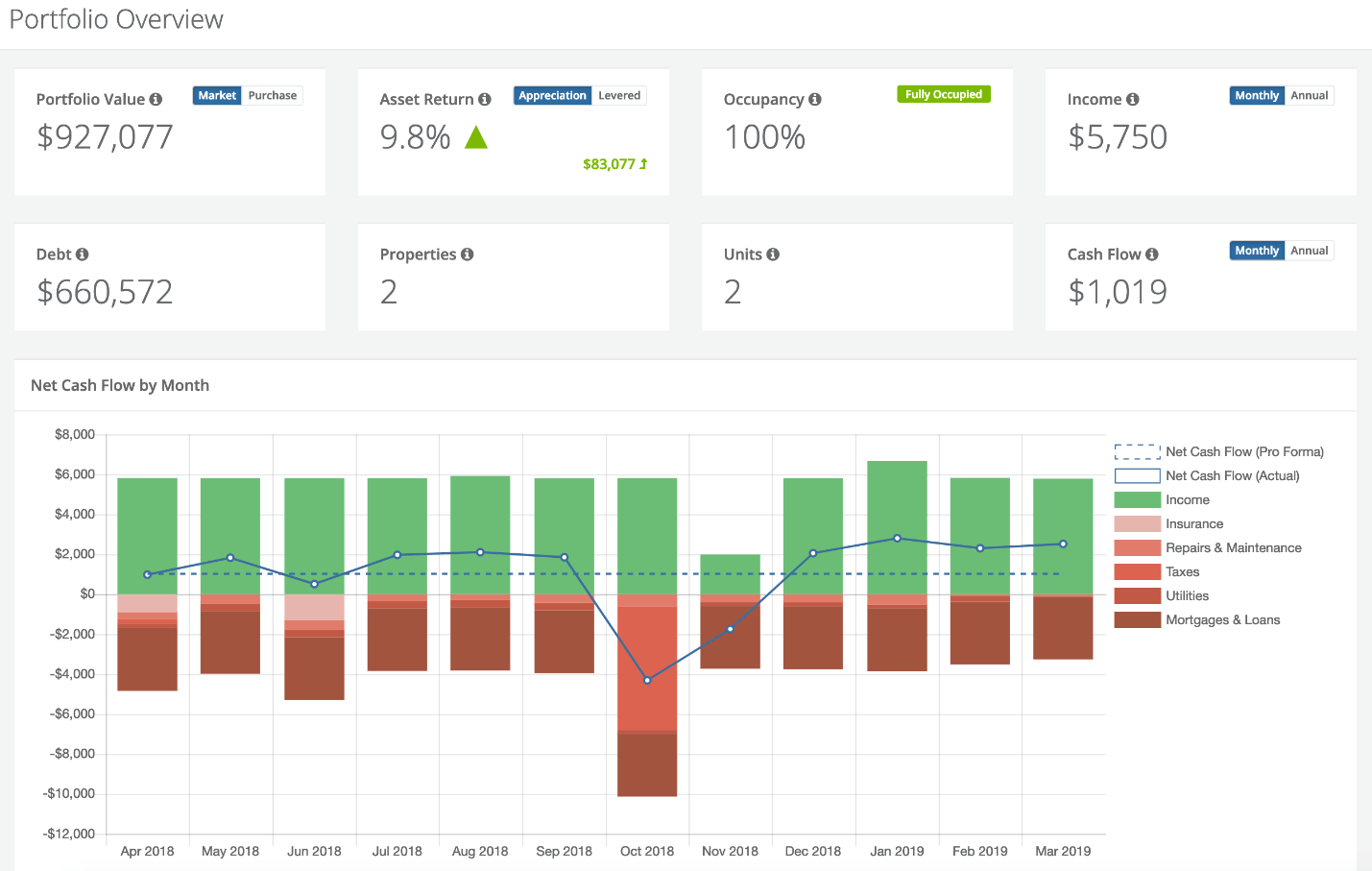

Permit'due south accept a await at what your personal dashboard on Stessa and reports will look like:

Sample Dashboard

Sample Income Statement

Sample Net Cash Catamenia Report

Stessa is 100% Gratuitous

Stessa'southward goal is to provide powerful tools for managing rental holding to investors at the everyman possible cost, which is why the system is absolutely gratuitous to use. Stessa does offer optional, premium services such every bit rent comps analysis, mortgage financing, and market place research.

Final Thoughts on Tracking Expenses

Expenses can have a large bite out of the rental income you lot receive for owning and operating a rental property.

Even if you lot ain just one rental home, it'due south easy to get quickly overwhelmed by keeping documents and receipts organized to brand certain that something doesn't autumn through the cracks. Misreporting expenses can accept a significant impact on your NOI, cash menstruum, and overall rate of return. Not to mention the increased risk of getting audited by the IRS.

Fortunately, tracking your rental holding expenses is very straightforward and easy to do without having to use an expensive, complicated accounting parcel or a holding management organization that gives you lot more than than you'll ever use.

Source: https://www.stessa.com/blog/how-to-track-rental-property-expenses/

0 Response to "Mobile App to Track Rental Properties and Upload Receipts"

Post a Comment